6 common approaches used across successful Real Estate portfolios

- 09-02-2026

- Business

- David Brown

- Photo Credit: Unsplash

Smart real estate portfolios rarely hinge on a single bet. They mix styles, balance risk, and keep dry powder for shifts. The goal is steady income, controlled volatility, and room to grow.

Build a Core-And-Core-Plus Base

Core assets are high-quality, in major markets, and leased to stable tenants. They produce predictable cash flow and anchor performance when cycles turn. Core-plus adds a small tilt to growth, as it targets solid assets with light value levers like minor capex, lease-up, or operational fixes. The mix can raise returns without jumping all the way into heavy redevelopment risk.

A review of European open-end funds in mid-2024 showed early signs of healing after a tough stretch. Research from DWS noted that a broad fund index turned modestly positive in Q2 2024, the first such move since early 2022. That kind of shift signals a bottoming process and a steadier base for core allocations going forward.

Tokenized and Fractional Exposure

Fractional ownership can shrink minimums and widen the investor base. With tokenization, settlement can be near instant, and transfers can be automated through a RealT tokenized real estate platform that issues digital shares tied to real-world assets. That lowers friction around cap table updates and secondary trading.

Blockchain rails can reduce operational overhead and speed the movement of capital. Smart contracts make it easier to handle distributions, governance votes, and compliance checks. For small investors, fractional shares open doors that used to require $50,000 checks or a seat at a private club.

Tokenized real estate is expected to scale toward $4 trillion by 2035, up from under $0.3 trillion in 2024, implying a fast compound growth path if infrastructure and regulation keep pace. Another researcher projects the tokenization market at about $3.5 billion in 2024 with a 21% compound rate into the next decade, suggesting steady momentum even in early innings.

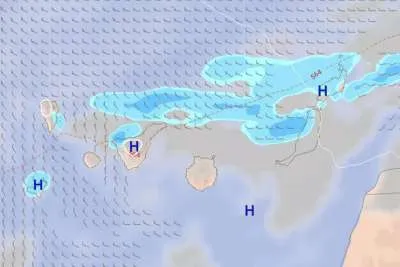

Geographic and Sector Mix

Different regions and property types move on their own cycles. Industrial may run ahead of the office. Sunbelt apartments can behave differently from gateway city towers. Spreading exposure helps smooth the ride when one area cools.

Think in layers. Start with broad national exposure, and add targeted slices in sectors you know well. Avoid putting all of your chips on the city or niche that did best last year. Diversification works slowly, and it tends to work when you need it most.

Quick ways to balance exposure:

- Use a total market REIT fund as the base, then layer sector ETFs in small doses

- Add private deals in regions where you have insight or partners on the ground

- Pair cyclical sectors like hotels with steadier segments like necessity retail

- Keep single property bets small relative to the overall plan

Add a REIT Sleeve for Liquidity and Pricing

Public REITs add daily pricing and fast rebalancing and open doors to sectors that are hard to buy directly, like data centres or cell towers. This sleeve can help fund new private deals without selling long-held assets at awkward times.

Listed and private REITs collectively sit on trillions in commercial real estate. That scale gives investors diversified access, broad disclosure, and seasoned management teams. It offers a way to express short-term views while the private market adjusts more slowly.

Consider a small but durable REIT sleeve that does clear jobs:

- Provide liquidity for rebalancing and capital calls

- Express tactical sector tilts during rate or rent shifts

- Serve as a benchmark for private asset underwriting spreads

Keep expectations realistic. Public markets can swing more day to day. The trade-off is transparency and quicker price discovery, which can sharpen private deal discipline.

Use Value-Add and Opportunistic Sleeves Thoughtfully

Value-add and opportunistic deals can lift total returns. They create value through redevelopment, lease-up, or re-tenanting. The key is crisp business plans, tight budgets, and realistic exit caps.

Many investors keep these sleeves smaller than core and core-plus. Underwriting should include multiple exit paths. If the lease-up lags, the team may pivot to different tenant mixes or phasing. Cash cushions, rate hedges, and conservative leverage help the plan survive bumps.

Risk Controls That Keep Portfolios Resilient

Good portfolios budget for the unknown. Rate sensitivity, lease roll, and capex cliffs need constant tracking. Early flags lead to small fixes before they become big problems.

Simple tools go a long way. Quarterly stress tests show what happens when rents fall, or financing costs jump. Exposure caps prevent one theme from growing beyond its lane. Clear sell rules set the stage for orderly exits.

Governance matters too. Investment committees that challenge base cases reduce bias. Post-mortems on both winners and misses sharpen playbooks. These habits compound more than any single pick.

Strong portfolios are built, not found. Start with a stable base, add growth where you have skill, and leave room for new tools that prove their value. This mix can deliver durable income and sensible upside without leaning on one narrow bet.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025