Safeguarding Your Investment: Managing Risks in Online Trading

- 21-11-2023

- Business

- Canarian Weekly

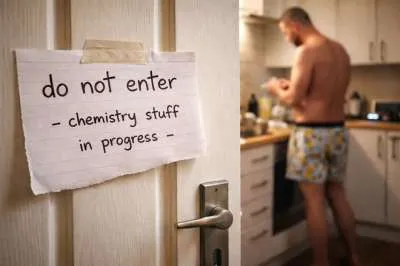

- Photo Credit: Entrepreneur

Online trading has gained immense popularity in recent years, offering individuals the opportunity to invest and trade in various financial markets from the comfort of their own homes. While the profit potential is enticing, it is essential to remember that online trading can be risky, and without proper risk management, one's capital can be at serious risk.

This article explores the critical aspects of risk management in online trading and how traders can safeguard their investments. To effectively invest in crypto, you may consider using a reliable trading platform like instantadvantageai.com.

Understanding Risk in Online Trading

Online trading involves the buying and selling of financial instruments such as stocks, forex, cryptocurrencies, and commodities. It presents numerous opportunities, but it also carries inherent risks. These risks include market volatility, unexpected news events, and the potential for significant losses. To navigate these challenges successfully, traders must employ effective risk management strategies.

Assessing Risk Tolerance

Before diving into online trading, individuals should evaluate their risk tolerance. Risk tolerance is the amount of uncertainty a trader can comfortably withstand without panicking or making impulsive decisions. It varies from person to person and depends on factors such as financial goals, time horizon, and overall financial situation. It's essential to recognize that trading styles can differ significantly; some traders are more risk-averse, while others are more willing to take risks.

Position Sizing

One of the fundamental principles of risk management is position sizing. This refers to the amount of capital allocated to each trade. Traders should never risk more than they can afford to lose on a single trade. As a rule of thumb, risking no more than 1-2% of your trading capital on any single trade is a prudent approach. By following this guideline, traders can mitigate the impact of potential losses and protect their capital.

Leveraging Risk-Reward Ratios

When traders enter a trade, they should have a clear understanding of the potential risk and reward. The risk-reward ratio is a crucial concept in risk management. It represents the relationship between the potential loss (risk) and the potential profit (reward) of a trade. A favourable risk-reward ratio can help traders ensure that their potential gains outweigh their potential losses.

Using Stop-Loss Orders

A stop-loss order is a risk management tool that sets a predetermined exit point for a trade. When a trade reaches this point, it automatically closes, limiting the trader's potential losses. Stop-loss orders are essential for preventing emotionally driven decisions during market fluctuations. Traders should always set stop-loss orders when entering a trade to protect their capital.

Diversification

Diversification is another key risk management strategy. It involves spreading your capital across different assets or asset classes to reduce the impact of a poor-performing investment. By diversifying, traders can avoid putting all their eggs in one basket. For example, a trader on the online platform might consider trading a mix of cryptocurrencies, forex pairs, and stocks to spread risk effectively.

Staying Informed and Adapting

The world of online trading is dynamic, with market conditions that can change rapidly. Traders need to stay informed about current events, economic indicators, and market trends that could impact their investments. Being proactive and adaptable is essential for effective risk management. Constantly reassessing your strategies and adjusting them as needed can help protect your capital in the long run.

Monitoring and Reviewing

Risk management is an ongoing process. Traders should regularly monitor their trades and review their risk management strategies. This includes assessing the effectiveness of stop-loss levels, position sizing, and overall portfolio performance. Regularly analysing and adjusting your approach can help you stay on top of potential risks and protect your capital over time.

The Role of Emotional Control

Emotions can play a significant role in trading decisions, often leading to impulsive actions that can jeopardize capital. Fear and greed are common emotions that can cloud judgment. Traders must develop emotional control to stick to their risk management plans and avoid making rash decisions based on momentary emotions. It's crucial to remember that discipline is a key component of successful trading.

Conclusion:

Online trading offers opportunities for financial growth, but it also comes with inherent risks. Effective risk management is essential for protecting your capital and ensuring your long-term success as a trader. By assessing your risk tolerance, employing position sizing, leveraging risk-reward ratios, using stop-loss orders, diversifying your portfolio, staying informed, and maintaining emotional control, you can navigate the online trading landscape with confidence. Approach online trading with a thoughtful and disciplined approach to safeguard your capital and maximize your potential for success.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025