Your Dream Job Abroad: Is the Salary as Good as it Looks?

- 13-01-2026

- Business

- Daniel Price

- Photo Credit: Freepik / Supplied

For many in the Canary Islands and across Spain, the allure of an international career is powerful. An email arrives with an offer from a German tech firm, a British university, or an American startup. The salary figure looks impressive, especially when converted to euros. It sparks dreams of professional growth, new experiences, and financial advancement.

But experienced expatriates and financially savvy professionals know a crucial secret: the number on the contract and the amount that funds your life abroad are often worlds apart.

The journey from gross salary to net take-home pay involves navigating a foreign tax system, social security deductions, and cost-of-living adjustments that can dramatically alter the picture.

Your Best First Move Before Saying "Yes"

Before you start researching neighbourhoods or schools in your potential new home, the most critical piece of planning is financial. You need to move beyond the attractive headline figure and understand your true disposable income. A simple currency conversion and a guess at tax rates won't suffice. The difference between working in Berlin and Munich, or between London and Manchester, can be significant due to regional tax variations.

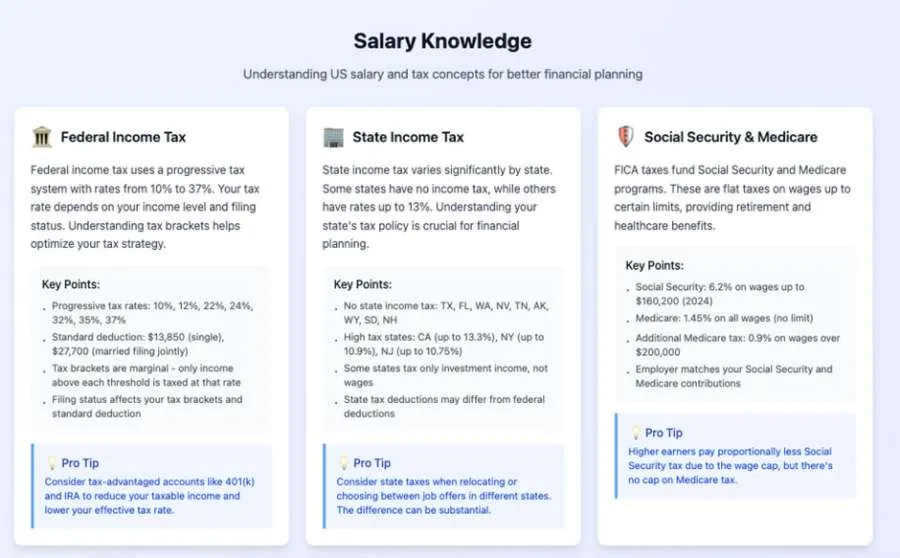

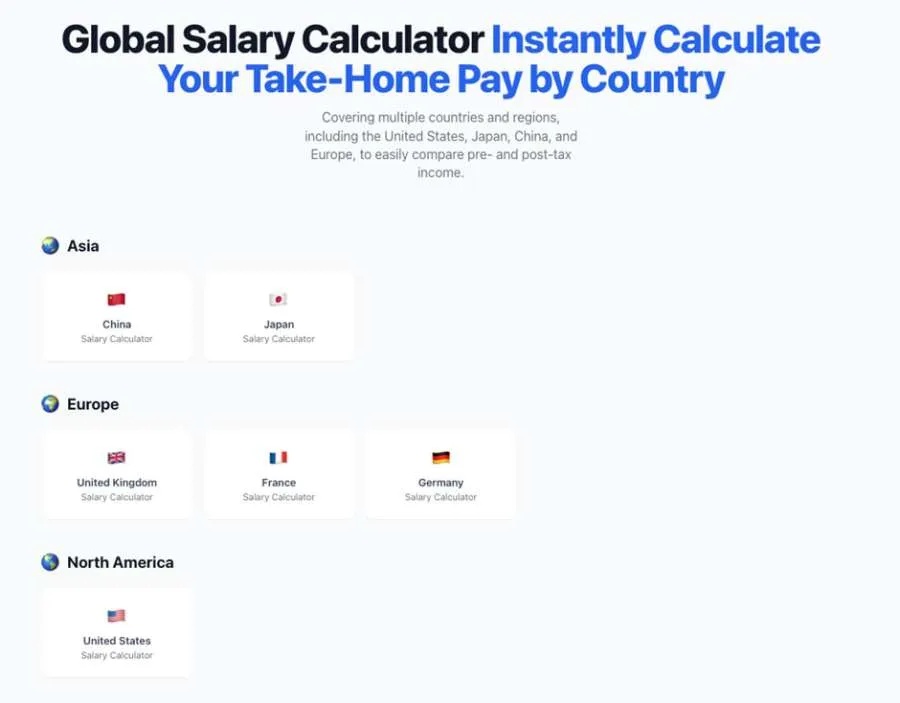

This is where a dedicated global salary calculator becomes your essential planning partner. It’s designed to do the complex translation for you. You input the offered salary and your potential work city, and it applies the specific, up-to-date tax codes and social security rules of that country and often that region to show you what will actually land in your bank account each month. For instance, using a detailed net salary calculator USA can reveal how state taxes in California or New York would impact an offer compared to a role in Florida or Texas.

Building Your Best Personal Budget for Life Overseas

Having a precise net income figure transforms international relocation from a hopeful gamble into a manageable plan. This clarity is the foundation for every other decision you'll make.

- Create Your Best Realistic Budget. Knowing your exact take-home pay allows you to accurately budget for rent, utilities, groceries, and insurance in your new city. You can compare this disposable income against the local cost of living to see if the offer truly allows for the lifestyle you envision, or if it will require tighter budgeting than you anticipated.

- Prepare for Your Best Negotiation. If the calculated net salary doesn't align with your financial needs, you can enter negotiations informed. Instead of simply asking for "more money," you can present a data-backed case, explaining how local taxes and living costs affect the offer's real value. This professional approach is far more effective.

- Make Your Best Comparison Between Opportunities. Perhaps you're weighing an offer in Switzerland against one in the Netherlands. The gross salaries might look similar, but the net results and cost of living will differ drastically. Country-specific calculators for Germany, France, the UK, and others let you cut through the complexity and compare the actual financial benefit of each path.

Finding Your Best Defence Against Financial Surprises

A common worry is the "tax bracket myth" the fear that a higher salary could be largely eaten up by moving into a higher tax rate. This is a misunderstanding of progressive tax systems. A reliable salary calculator will show you a clear breakdown, proving that only the portion of your income above a threshold is taxed at a higher rate, and that a larger gross salary always results in more net income. This dispels anxiety and lets you evaluate the offer on its true merits.

For anyone considering a move from the Canaries to mainland Europe, the UK, or further afield, this step is not just about number crunching. It’s about due diligence. It's the difference between being pleasantly surprised or unpleasantly strained by your new financial reality.

An international move is a major life adventure. Ensuring it is also a sound financial decision starts with one simple, powerful action: knowing exactly what you'll earn. Take the time to calculate your real take-home pay. It’s the smartest investment you can make in your future abroad.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025