Richest 1% of the Canary Islands population hold nearly 30% of wealth

- 22-09-2025

- National

- (INE) National Institue of Statistics

- Photo Credit: Freepik

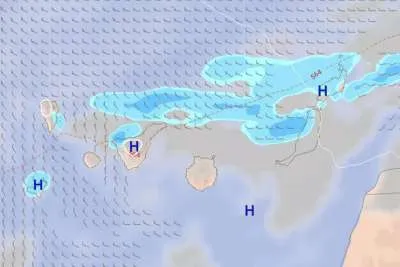

The Atlas of Wealth in Spain has highlighted the Canary Islands as one of the most unequal regions in the country, with the richest 1% of the population controlling almost 30% of all wealth.

The study, based on data from the Spanish Tax Agency, the National Statistics Institute (INE) and the Institute of Fiscal Studies, places the archipelago alongside Madrid (35%), the Balearic Islands (28%) and Catalonia (28%) at the top of the inequality scale.

At the opposite end, the poorest 50% of Canary households hold just 4.2% of total wealth, compared to the national average of 7%. The report underlines a dual challenge for the islands: a low level of average household wealth combined with one of the most unequal distributions in Spain.

Wealth gap across Spain

Madrid leads the ranking with 35% of regional wealth concentrated in the top 1% – the highest figure in the country and well above the national average of 26%.

The Canary Islands, with nearly 30%, follow closely behind, while regions such as Castilla-La Mancha, Asturias or Aragón show much lower levels of wealth concentration and greater balance.

Below-average wealth

The average household wealth in the Canaries stands at €250,000, significantly lower than the national average of €383,000, and well below Madrid (€687,000), the Balearics (€477,000) and Catalonia (€434,000).

The archipelago’s Gini index, a key measure of inequality, was 75.2 in 2022, one of the highest in Spain and only surpassed by Madrid.

Housing versus financial assets

For most Canary households, the bulk of wealth lies in main homes and secondary residences. By contrast, the wealthiest households diversify through investment properties, businesses, shares and financial funds, which widens the gap with the middle class.

While the poorest 20% of households have an average wealth of just €3,700, mainly in current accounts, the richest 1% average more than €10.4 million per household in highly diversified assets.

Economic and social risks

Economists warn that such inequality makes the Canarian economy especially vulnerable. With half of households lacking savings or liquid assets, consumer spending falls sharply during downturns, worsening recessions and slowing recovery.

High wealth concentration also limits opportunities for investment and entrepreneurship, which could restrain long-term growth and deepen social exclusion. This is particularly concerning in the Canaries, where the economy relies heavily on tourism and other sectors prone to external shocks.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025