Tax Office issues serious warning to owners of rental properties

- 09-05-2024

- National

- Canarian Weekly

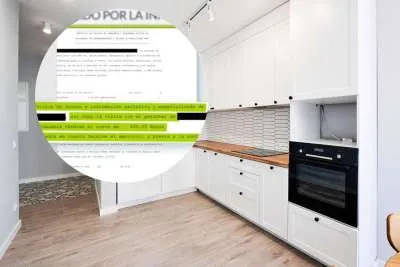

The Spanish Tax Office (Agencia Estatal de Administración Tributaria) is warning owners of rental properties in the Canary Islands about the importance of fulfilling their tax obligations, as renting out properties not only yields economic benefits but also entails significant tax responsibilities, including the need to declare rental income in a Personal Income Tax (IRPF) return.

During the Income Tax filing period, it's crucial for property owners who rented out their properties in 2023 to file their returns with the Tax Agency before June 3rd, 2024 If resident or non-resident owners fail to do so, there are “serious” penalties and fines with interest for non-payment that can run into ‘thousands’ of euros.

These incomes are generally categorised as “real estate capital gains”, encompassing revenues from both urban and rural properties, provided they are not directly related to economic activities, i.e. for businesses.

According to information available on the Hacienda website, rental incomes from any type of property, whether residential dwellings, commercial premises, or parking spaces, must be included in the tax return. Additionally, owners may benefit from some tax deductions for rented properties.

If the rental is used for a business activity, meaning with at least one full-time employee hired, then it must be declared as an economic activity rather than real estate capital gains.

As for holiday lets and tourist rentals, these are considered non-residential leases, and their incomes are also classified as real estate capital gains unless they involve an economic activity with full-time employees.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025