Profitability of Crypto Mining: Is it Worth the Investment?

- 23-04-2023

- Business

- Canarian Weekly

In recent years, cryptocurrency mining has gained popularity as a form of investment. The popularity of cryptocurrencies has increased the demand for mining hardware and software. However, several variables, including mining complexity, electricity prices, and equipment expenses, affect how profitable cryptocurrency mining is.

Sign up to the official site of Bitcoin 360 AI to learn more. In this article, we'll examine if cryptocurrency mining is profitable. We'll do our best to highlight all the variables and topics about the profitability of mining cryptocurrencies. Without any further delays, let's start with the variables that impact profitability.

Factors affecting profitability in crypto mining.

Many factors affect profitability and some of them are mentioned and explained below:

1 Mining difficulty.

If you have ever wanted to start mining, it's possible that you've done some study into the procedure and learned about the work required. It is a challenging task, and success requires whole dedication to the field. Also, technology is becoming widely accepted throughout the world, drawing more individuals to it. The difficulty is rising in tandem with the level of competition.

2 Electricity costs.

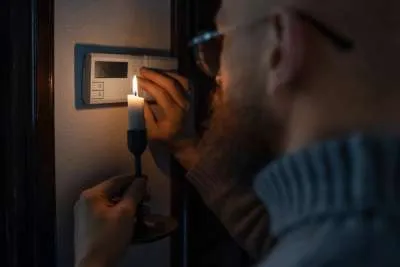

Another vital aspect of profitability in cryptocurrency mining is electricity expenses. The process consumes a lot of energy in addition to a lot of processing resources. The location has a big impact on the price of power, with some places having substantially higher prices than others.

3 Hash rate.

The hash rate is the measure of the computational power used in the process. The higher the hash rate, the faster the miner can mine new blocks. However, a higher hash rate also means higher energy consumption and equipment costs. Therefore, finding the optimal hash rate is critical to maximizing profitability in crypto mining.

4 Mining pool fees.

Mining pools are groups of miners who pool their resources to mine new blocks together. While mining pools can help reduce the volatility of mining rewards, they also charge fees for their services. These fees can significantly impact mining profitability, so it's important to carefully consider the fees associated with different mining pools.

5 Equipment costs.

If you don't have high-end appropriate equipment, you can have the desired outcome. Equipment can include hardware, software, a high-performance and durable computer system with high hash rates, and many more. The price of the equipment also adds up and the profitability gets a bang for sure.

Cost-benefit analysis of crypto mining.

To determine whether crypto mining is worth the investment, it's essential to perform a cost-benefit analysis. This analysis involves calculating the potential profits and comparing them with the investment costs. There are various online calculators available that can help miners estimate their potential profits based on their hash rate and electricity costs.

However, it's also important to consider the risks associated with crypto mining. Cryptocurrencies are volatile, and their value can fluctuate significantly. This means that mining rewards can also be unpredictable, and miners may not always earn the profits they expect. Therefore, it's crucial to carefully consider the risks before investing in crypto mining as you may require many things to start mining.

Comparison with other investment opportunities.

When considering whether crypto mining is worth the investment, it's also important to compare it with other investment opportunities. While crypto mining can be profitable, it's not the only investment opportunity available. Traditional investments, such as stocks and bonds, can also provide good returns, depending on the market conditions.

Moreover, there are other cryptocurrency investment opportunities available, such as buying and holding cryptocurrencies or investing in crypto-related companies. These investment options may offer better returns than mining, depending on market conditions and individual investment strategies. It depends upon the person and the financial goals to choose between mining and other investment opportunities like investing or trading.

Conclusion:

In conclusion, several variables, including mining difficulty, electricity prices, hash rate, mining pool fees, and equipment expenses, affect how profitable cryptocurrency mining is. Before engaging in cryptocurrency mining, miners should conduct a cost-benefit analysis and thoroughly assess the dangers.

Even though cryptocurrency mining might be lucrative, there are other investment choices accessible, so miners should weigh their options carefully before making a choice. For a healthy environment, make sure you also consider the industry's effects on the environment and strive to choose eco-friendly energy sources.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025