Gambling Taxes in the Canary Islands: What You Need to Know

- 01-07-2025

- Business

- collaborative post

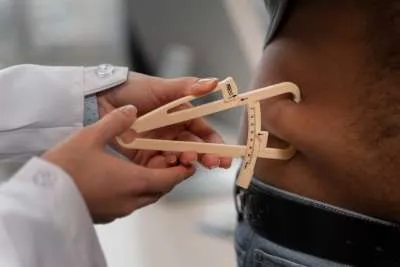

- Photo Credit: Freepik

The Canary Islands are gradually emerging as a top pick for punters, as this natural paradise is slowly turning into an innovative hub for the gaming industry.

Winning a jackpot seems like a dream for many tourists and residents, but it comes with its fair share of taxes, so it is important that you understand their tax obligations to avoid running into issues with the local governments.

While the Canary Islands are part of Spain, they have unique tax rules. Local establishments and non GamStop Casinos abide by these gambling tax rules. So, let’s look more closely at the world of gambling taxes in the region.

Understanding Gambling Taxes in the Canary Islands

The Canary Islands are fully integrated into the European Union (EU). Also, it falls subject to Spanish law and its own laws regarding gambling taxes.

Popular types of gambling on the islands include land-based casinos such as roulette, blackjack, and slot machines. Also, there’s a growing trend of online betting from smartphones. Other popular options include lottery and poker events.

The Canary Islands have a ‘special’ freedom regarding their finances and laws, known as the Economic and Fiscal Regime (REF). They can tweak tax rules on the islands to make them more attractive.

Despite the intervention by REF, gambling taxes on winnings often fall on the side of the Spanish laws.

Taxes on Casino Winnings

Let’s say you got lucky at a brick-and-mortar casino and walked away with your winnings. The big question is – will it be taxed? In Spain (including the Canary Islands), all gambling winnings are generally considered taxable income. For larger amounts, typically above €2,500, the casino is required to withhold tax on your behalf.

However, when playing at an online casino ohne OASIS, especially one licensed outside of Spain or Germany, the rules may differ. Many of these platforms are based in jurisdictions where player winnings are not taxed at source, giving players more control over their payouts. Still, it’s important to stay informed about your local tax responsibilities if you’re playing across borders.

The tax-winning rules are consistent across Spain, including the Canary Islands. The local government sets the gambling tax rates on winnings by individuals.

Online Gambling Taxes in the Canary Islands

There’s little difference in tax winnings from online casinos or sportsbooks. Whether you win at a land-based or online casino, you’ll be considered a tax resident in Spain, and winnings over the set limit are treated the same way for tax purposes.

Both international and local online gambling sites fall under the purview of DGOJ (General de Ordenación del Juego). This means licensed online casino sites and sportsbooks operating legally in Spain follow national rules regarding gambling taxes.

How Gambling Taxes Are Collected

The casino itself handles large winnings at land-based casinos with tax withholding on behalf of punters. Therefore, you’d receive your winnings after tax deductions. For online casinos, it’s generally your responsibility as a player to report it as income. The online casino won’t necessarily withhold tax on your behalf.

For tax filing, Spanish residents (including the Canary Islands) are supposed to declare their annual income tax return. This is through their Personal Income Tax declaration. Therefore, punters must keep accurate records of winnings and losses.

The tax collection methods remain similar across Spain for individual gambling taxes. The national tax agency handles the mandate.

Special Tax Benefits in the Canary Islands

The Canary Islands offer tax incentives for casino operators setting up within the Special Canary Islands Zone. This often comes with low corporate tax rates. But these incentives aren’t directly linked to an individual punter.

Despite the tax incentives, it doesn’t mean your winnings at these establishments are tax-free.

The gambling scene in the Canary Islands is far more attractive compared to Spain due to the low general taxes. For example, there’s a 21% VAT on mainland Spain (IVA) , compared to 7% on the Canary Islands (IGIC).

Some advantages locals and foreign residents can accrue compared to mainland Spain are the low cost of living due to the tax regime.

Implications for Tourists and Foreign Residents

For tourists and foreign residents trying their luck at casino games, remember you’re still subject to the Spanish gambling tax rules. The casino is legally obligated to withhold tax directly.

For residents of the Canary Islands, you’re considered a tax resident. All winnings fall under the taxable income for your Spanish tax return. This applies to both land-based and online casino sites.

Conclusion

There’s a palpable excitement in the air for punters looking for authentic gaming experiences in the Canary Islands. However, local residents and foreigners should understand that gambling winnings are subject to taxes.

Any winnings from gambling activities are subject to taxation. Residents have to fill out their tax obligations as these winnings fall under taxable income. On the other hand, tourists and foreigners get their tax obligations withheld at the physical casino.

We highly recommend that both local residents and foreigners seek professional advice when dealing with complex tax situations or making substantial winnings.

Gamble Responsibly: Gambling should be enjoyed as a form of entertainment, not a way to earn money. Always gamble within your financial means and set limits to stay in control. You must be 18 or older to participate in gambling activities. If you or someone you know has a gambling problem, seek help from organisations like FEJAR (Federación Española de Jugadores de Azar Rehabilitados) at www.fejar.org. Stay safe and gamble responsibly.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025