40% of new homes in the Canary Islands are owned by people with five or more properties

- 02-11-2024

- Business

- Canarian Weekly

- Photo Credit: Pisos.com

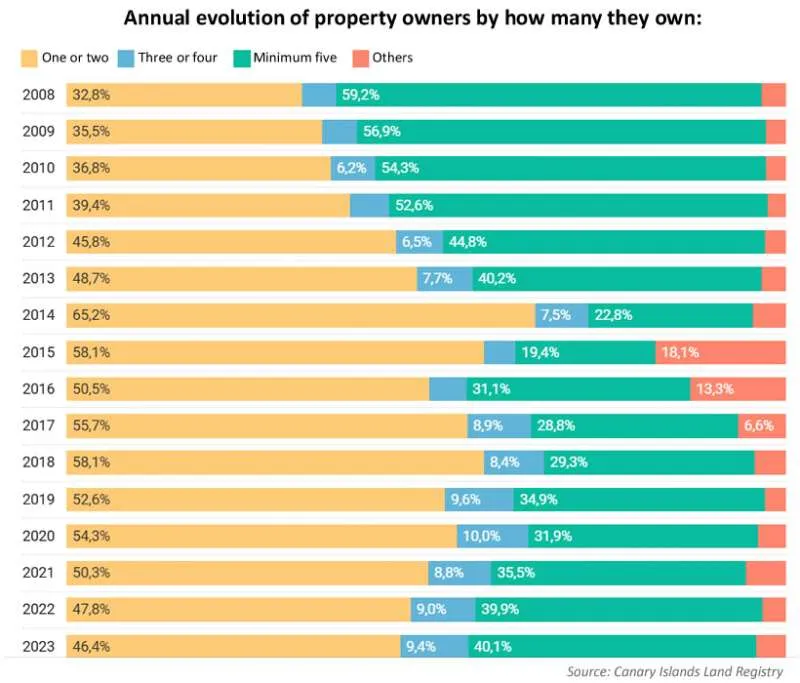

The latest data from the land registry reveals that 40% of newly registered homes in the Canary Islands belong to owners with at least five properties. The trend marks a significant shift from a decade ago, with small property holders declining sharply by over 40% since 2014. Experts attribute this change to a dual demand: while some residents seek homes to live in, others pursue property for investment purposes.

The Canary Islands’ Housing Minister, Pablo Rodríguez, has stressed the importance of construction to address the region’s housing crisis, highlighting a "growing demand" for homes. This statement coincided with his visit to a new public housing construction project in Tenerife, part of the government’s €4 billion housing initiative, which draws on EU funds and additional state support.

Small Property Owners Decline as Large Investors Increase

According to the Canary Islands cadastre, nearly 11,000 new homes were registered in 2023, the highest figure since 2015. However, these registrations reveal a growing divide between small, individual homeowners and large investors.

Individual owners with one or two properties now account for only 46% of new registrations, while entities with five or more properties hold a 40% share. This surge of large investors is the highest recorded since 2013, a trend that initially slowed after the 2008 economic recession but has since accelerated.

Sociologist Jordi González of the University of Leeds notes that individual homebuyers face challenges competing with larger investors, who leverage significant resources to acquire properties as investments. González highlights how the housing market is increasingly dominated by those seeking to maximise returns, making homeownership challenging for typical families.

Economic Inequality and Regulatory Concerns

Housing affordability remains a pressing issue in the Canary Islands, where 65% of residents report struggling to meet monthly expenses. The growing presence of institutional investors exacerbates the housing shortage, as these entities can drive prices upward. In 2023, physical persons registered 59% of new properties, a drop from 68% in 2020, while registrations by legal entities (companies) rose to 39%.

Dr. Ángela García Bernardos, an expert in Public Policy from the University of Barcelona, criticises the simplistic economic principle that more construction alone will solve housing issues. “Housing prices don’t behave like other goods,” Bernardos argues, explaining that factors like location and uniqueness make housing prices particularly resistant to change. She also points out that residential properties in Spain are often seen as investment channels, maintaining high value even after extended use.

Market Shifts and Policy Challenges

The current housing policies in the Canary Islands focus heavily on increasing housing supply, which the government argues is essential to addressing demand. However, critics argue that without complementary measures, simply adding more housing will not effectively stabilise prices. Both González and Bernardos call for stronger regulations on rental prices and incentivising the use of empty properties, measures they believe could mitigate the impact of speculative investments.

The government’s recent housing decree aims to expand the availability of public and private homes, but the actual impact remains unclear. The regional government is now working with the Canary Islands Federation of Municipalities to assess progress, though only 1,338 homes were completed in 2023, none of which were subsidised housing.

The trend of large investors dominating the Canary Islands’ property market is in line with national trends driven by institutional investors and specialised real estate companies. These entities benefit from favourable tax conditions, such as exemptions from corporate tax for real estate investment trusts, allowing them to buy more properties with less tax liability.

With the housing crisis deepening, experts warn that treating homes primarily as financial assets will lead to more inequality. As Bernardos observes, “When families compete against corporations for a home, the market increasingly serves those with greater capital, transforming housing into a commodity rather than a basic need.”

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025