The number of VV beds in Tenerife is now close to the number of hotel beds available

- 09-06-2025

- National

- Canarian Weekly

- Photo Credit: CW Stock Image

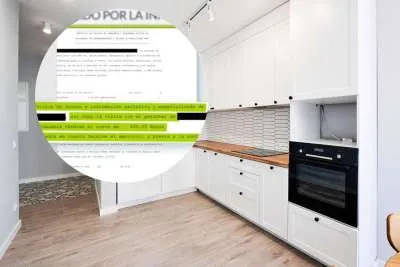

The number of holiday rental properties in Tenerife are rapidly catching up with traditional hotel accommodation, with new figures revealing the gap between the two is now only 4,000 beds.

According to the Canary Islands’ official statistics agency (ISTAC), there are now 84,463 holiday rental beds spread across more than 20,000 properties on the island, just short of the 88,588 hotel beds available. This represents nearly a 30% increase in holiday rental capacity since 2019.

Meanwhile, the hotel sector has barely moved, growing by just over 1% in the same period. Industry insiders point to strict regional planning laws, which allow new hotel builds in only the luxury category, and renovations that have reduced bed numbers to boost hotel star ratings.

Unregulated Growth

The boom in holiday lets has reignited long-standing calls from the hotel sector for tighter controls. The Canarian hotel association says the current system has allowed unchecked growth, distorting the market and overwhelming local communities.

In response, the Canary Islands Government is drafting a new law to bring order to the sector. But the move has drawn fire from the Canary Islands Holiday Rental Association (ASCAV), which claims the legislation is too heavy-handed and could eliminate 90% of current listings.

They argue that holiday lets “democratise tourism income” and contribute 3% to the archipelago’s GDP.

Changing the Face of Tourism

Tenerife is leading the charge when it comes to holiday rental growth, now accounting for 41% of all short-term beds in the Canary Islands, well ahead of Gran Canaria, which hosts just 22%.

The distribution of holiday lets is also far wider than that of hotels. While 97% of hotel beds are concentrated in just nine key tourist towns like Adeje and Arona, only 67% of holiday rental beds are in those same hotspots. The remaining 20,000 are scattered across the island’s other municipalities.

In some areas, rentals have already overtaken hotel options. The island’s capital, Santa Cruz, now has more holiday rental beds (3,710) than hotel beds (2,679). In La Laguna, the gap is even wider, with rentals outnumbering hotel beds nearly four to one.

High Demand, High Stakes

Demand remains strong. In April, short-term holiday rentals boasted an average occupancy rate of 89.5%, compared to 76.9% for hotels, according to ISTAC data.

But with housing availability a growing concern and tourism pressure rising, the Canary Islands’ government now faces a balancing act: how to regulate the sector without crippling an increasingly important part of the tourism economy.

The proposed law is expected to define where and how holiday rentals can operate, a move that could reshape the island’s tourism model for years to come.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025